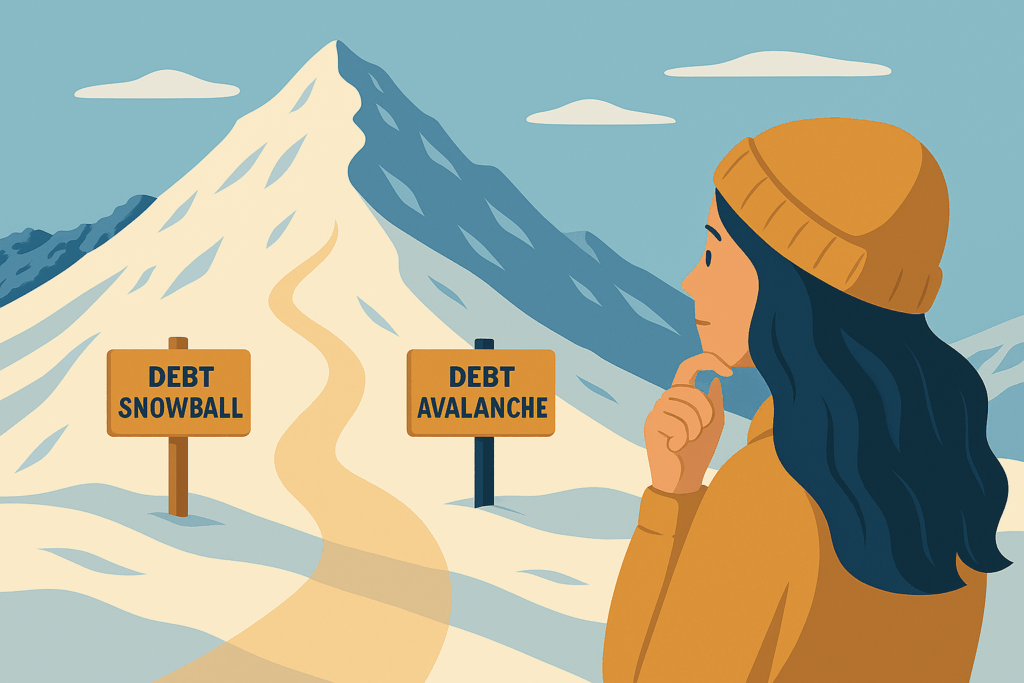

If you’ve started tackling your debt, you’ve likely come across two popular repayment strategies: debt snowball vs avalanche. These two methods take different approaches to the same goal—getting you out of debt faster and with less stress. But which one is right for you?

Before you commit to either, it’s worth understanding how they work, how they compare, and which strategy aligns better with your personality and financial goals.

Understanding the Debt Snowball Method

The debt snowball method prioritizes momentum over math. You start by listing all your debts from smallest to largest balance. While making minimum payments on all of them, you throw any extra money at the smallest debt first. Once that’s gone, you move on to the next smallest—like rolling a snowball downhill.

Why People Love the Snowball Approach

The biggest advantage of this method is motivation. Paying off a debt—any debt—feels good. These small wins build confidence and keep you engaged in the process, especially if you’ve struggled with debt for years.

Psychologically, this method works because it creates quick results. According to a study shared by Purdue University, individuals who used the debt snowball were more likely to stick to their repayment plans than those who used more mathematically efficient strategies.

That said, the snowball method may cost you more in interest over time—especially if your smallest balances have low rates and your higher balances are charging double-digit APRs.

Understanding the Debt Avalanche Method

The debt avalanche method is all about minimizing interest. You start with the debt that has the highest interest rate, regardless of balance. Once that’s paid off, you move to the next highest rate, and so on.

Why the Avalanche May Be Smarter—On Paper

If you’re the type who wants to save the most money and get out of debt faster in total time, this method could be your best bet.

Let’s say you have a $1,000 credit card at 25% APR and a $3,000 personal loan at 8% APR. The avalanche tells you to knock out that 25% card first—because even though it’s a smaller balance, it’s costing you way more in interest every month.

It’s the logical, cost-effective option. But there’s a catch: the avalanche method doesn’t always offer early “wins.” If your highest-interest debt also has the largest balance, it may take a while before you feel like you’re making progress.

Debt Snowball vs Avalanche: Which One Is Best for You?

Here’s the truth: there’s no one-size-fits-all answer. Choosing between the debt snowball vs avalanche method really depends on your personality, financial behavior, and what will keep you motivated long enough to reach the finish line.

Choose the Snowball If:

- You need early motivation to stay on track

- You’re overwhelmed by the number of accounts

- You’re more emotional than analytical when it comes to money

Choose the Avalanche If:

- You want to pay the least amount in interest

- You’re good at staying disciplined without quick wins

- You’re comfortable sticking to a plan for the long haul

Can You Combine Them?

Absolutely. Many people start with the snowball to gain momentum and switch to the avalanche once they’re more confident. Others mix and match based on debt types or goals. The best strategy is the one that keeps you moving forward.

Not Sure Where to Start? Consider Your Other Options

If you feel like you’re spinning your wheels with high-interest debt, repayment strategies are just one option. For some, debt consolidation may make more sense. It can simplify your payments and potentially lower your interest rate—helping you get out of debt faster without choosing between snowball and avalanche.

Final Thoughts

At the end of the day, both the debt snowball and avalanche methods work—if you stick with them. Whether you’re motivated by small victories or big-picture savings, understanding your own habits is key. Use whichever approach helps you stay consistent, and remember: the best method is the one that gets you to zero debt.